Written by: Francesco Palmieri

Edited by: Sonia Khan

Introduction

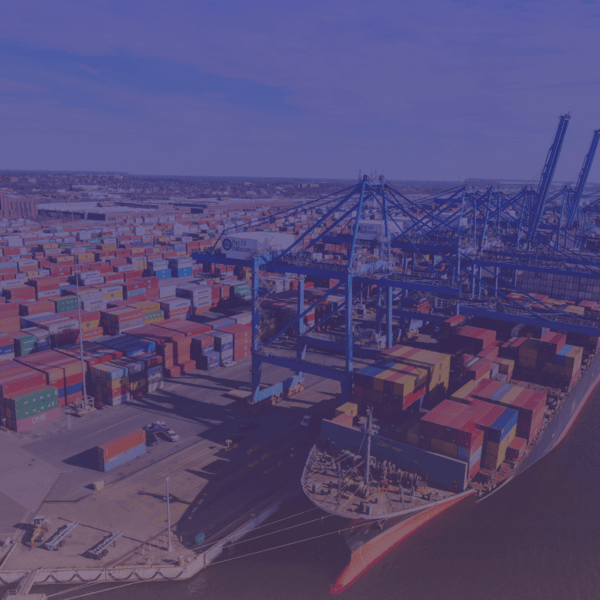

Since the outbreak of the war in Ukraine in February 2022, the Western response (EU and US) has included massive and unprecedented sanctions against Russia to maximise the pressure on the Kremlin, that included individual and economic sanctions, diplomatic and visa measures (European Parliament, 2025). Among these critical sanctions were those targeting Russia’s oil exports, which have historically been the backbone of Moscow’s budget. However, despite EU embargoes, G7 price caps, and a vast array of financial and logistical constraints, Russia has continued to exporting oil at volumes and prices that far exceed initial predictions, selling over the $60 per barrel price cap imposed by western sanctions throughout these past three years (Chiusa, 2025). To achieve this objective, the Kremlin has been utilising a strategic instrument known to the public as “shadow fleet”—a “constellation of old, poorly, or completely unregulated and strategically refloated oil tankers”—that has enabled the maintenance and rerouting of exports, has retained revenues and has constantly challenged the integrity and structure of international regulatory maritime regimes. Moreover, this shadow fleet is beyond an expensive and strategic vehicle to evade sanctions: it represents Russia’s reliance on informal governance structures and hybrid economic strategies in the face of external constraints. It is, therefore, a structural component of a statecraft that thrives in legal ambiguity and authoritarian adaptability, and that has institutionalised informality as a tool of survival and resilience in a hostile geopolitical environment.

Russia’s Shadow Fleet: A Covert Instrument of State Influence

According to the Kyiv School of Economics (2024), the shadow fleet is defined as “consisting of non-G7/EU-owned or managed vessels navigating without Internal Group (IG) protection and indemnity insurance.” Hence, such vessels transport Russian oil outside the G7/EU-sanctioned infrastructure are owned or managed by entities outside the Western jurisdictions. The origins of Russia’s use of informal maritime logistics dates back before the war in Ukraine began. In fact, Russia had occasionally relied on clandestine oil shipments to mitigate sector-specific sanctions or logistical constraints, even before February 2022 (Kyiv School of Economics, 2024).

The situation, however, escalated when the war broke out, as the sixth EU sanctions package in June 2022 banned most seaborne crude oil imports from Russia. The following December, the G7 also introduced a price cap regime, triggering a state-driven expansion of the shadow fleet, as almost 90% of EU oil imports from Russia were covered by this embargo (EPRS, 2024). According to the European Parliamentary Research Service (2024), Russia expanded its fleet by offloading tankers from the state-owned company Sovcomflot to third-party managers mainly based in the United Arab Emirates (UAE) and elsewhere before December 2022. Then, vessels over 15/20 years old from the “global cleared fleet” were reflagged to jurisdictions like Gabon, Liberia, Malta, Panama, and the Cook Islands, which are less inclined or unable to adhere to Western sanctions. Additionally, the sales by Western companies of these vessels do not violate any US, EU, or UK sanctions, since these ships have been sold to firms registered in the mentioned countries; in some cases they have been even resold a second or third time before eventually ending up operating in the Russian shadow fleet (Organisation and Crime Corruption, 2025).

According to a report by the Kyiv School of Economics (2024), the total number of vessels transporting Russian crude oil between 2023 and mid-2024 has exceeded 430. However, only a subset of these vessels operates on a regular basis. Scholars at KSE argue that these ships follow shadow-specific routes, often undergoing ship-to-ship transfer in international waters to obscure the cargo’s origin. More recent reports estimate that by 2025, the shadow fleet has increased to 848, comprising 463 crude oil tankers and 385 oil product carriers (Razom we stand, 2025).

Russia’s Shadow Fleet and Its Strategic Ambiguities

The evolution of the shadow fleet, however, represents something that goes beyond a complex and expensive endeavour to ensure economic survival in face of western sanctions, given that the Kremlin has spent more than $9 billion to build it (Kyiv School of Economics, 2024). It reflects a governance feature of the Russian state, which has long relied on what Alena Ledeneva (2013) famously conceptualised with the word sistema: a multi-faceted framework that

Ledeneva defines it as a mode of governance that blends informal practices and networks into the functioning of formal institutions, serving as the tissue of political and economic control. In this context, the Russian Shadow Fleet can be viewed as an extension of this logic: more than a workaround, it is a projection of Russian informal sovereignty in maritime logistical space.

For instance, reflagging vessels in jurisdictions like Gabon and using third-party intermediaries that do not adhere to Western sanctions are practices that allow Russia to benefit from global maritime trade while officially operating outside its governmental and institutional mechanisms. The shadow fleet is an emblem of informal resilience and adaptation to sanctions, which aim to exempt Moscow from legal contracting, port access, and maritime insurance.

Conclusion

The Russian shadow fleet is not only a pragmatic instrument for avoiding sanctions but represents a structural dependency of the Kremlin on informal governance, which arises from the country’s own legal and political structures. The fleet reflects the philosophy of a regime rooted in the sistema abroad, as Alena Ledeneva conceptualised. It is by projecting this logic of informal

sovereignty into the maritime domain that Russia sustains its vital oil revenues, while evading sanctions and contributing to the erosion of the legal and institutional systems established by the West.

Bibliography

Ledeneva, A. V. (2013). Can Russia modernise? Sistema, power networks and informal governance. Cambridge University Press. https://research.ebsco.com/linkprocessor/plink?id=d4b0401a-86a4-3063- 94a0-10768bc89905

Brookings Institution. (2024). The race to sanction Russia’s growing shadow fleet. https://www.brookings.edu/articles/the-race-to-sanction-russias-growing shadow-fleet/

European Parliamentary Research Service. (2024). Russia’s shadow fleet: Bringing the threat to light (Briefing 766242). https://www.europarl.europa.eu/RegData/etudes/BRIE/2024/766242/EPRS_B RI(2024)766242_EN.pdf

Von Soest, C. (2023). The resilience of authoritarian regimes against sanctions (GIGA Working Paper No. 336). GIGA German Institute for Global and Area Studies. https://pure.giga hamburg.de/ws/files/49014203/GIGA_WP_336.pdf#page13

Geopolitical Monitor. (2024). Russia’s shadow fleet: A masterclass in sanctions evasion. https://www.geopoliticalmonitor.com/russias-shadow-fleet-a masterclass-in-sanctions-evasion/

Kyiv School of Economics. (2024). Assessing Russia’s shadow fleet: Initial build-up, links to the global shadow fleet, and future prospects. https://kse.ua/about-the-school/news/assessing-russia-s-shadow-fleet-initial build-up-links-to-the-global-shadow-fleet-and-future-prospects/

Kyiv School of Economics. (2024, October). Shadow-free zones: Proposal for the implementation of an insurance requirement to address key environmental risks. https://kse.ua/wp content/uploads/2024/10/Shadow_free_zones_October_2024_final.pdf

Organized Crime and Corruption Reporting Project. (2025). European ships keep Russia’s shadow fleet afloat. https://www.occrp.org/en/investigation/european-ships-keep-russias-shadow fleet-afloat

Razom We Stand. (2025). Addressing the Russian shadow fleet threat with a joint EU and allies approach for enhanced targeted sanctions. https://razomwestand.com/briefing-note-addressing-the-russian-shadow-fleet threat-with-a-joint-eu-and-allies-approach-for-enhanced-targeted-sanctions/

The ’Ndrangheta’s Infiltration and Threat to European Institutions

The ’Ndrangheta’s Infiltration and Threat to European Institutions  From Paper to Practice: How Grassroots Norms Undermine Gender Rights in Pakistan

From Paper to Practice: How Grassroots Norms Undermine Gender Rights in Pakistan  Exploited Childhoods: The Role of Global Corporations in Perpetuating and Mitigating Child Labour

Exploited Childhoods: The Role of Global Corporations in Perpetuating and Mitigating Child Labour  Human Rights Challenges in Addressing SLAPPs in Media, NGOs and Journalism in the EU

Human Rights Challenges in Addressing SLAPPs in Media, NGOs and Journalism in the EU