Written by James Balzer

Disclaimer: The interviewees for this article are employees of the International Energy Agency (IEA) and the World Trade Organisation (WTO). However, their expressed perspectives, communicated in this article, do not necessarily represent the views and stances of the IEA or WTO.

The G20 summit this year arrived at an opportune time for reformation and change across the globe. Having been held in Riyadh from 21-22 November, it came not only at the tail-end of the COVID-19 crisis, but at the beginning of a new decade, and thus, a new paradigm. The exponential innovations of the 2010s have collided with a global system predicated on promiscuity and risk, resulting in suboptimal resilience and sustainability, as proven by the twin crises of the Anthropocene and COVID-19. This is across social, economic and environmental facets, and beckons a renewed consideration of our global order and underpinnings for a more equitable, resilient and sustainable world.

A year-old report by Bank of America Merrill Lynch, titled ‘Transforming World: The 2020s’, outlined a multifaceted and complex prognosis for this coming decade (see Bank of America Merrill Lynch, 2019). The article highlights the paradigmatic disruption the 2020s will instill, counteracting the zeitgeist of the 21st century thus far. While this is somewhat a product of speculation, it highlights the need for ‘unlearning’ and ‘relearning’ amongst individuals, governments and businesses in the brave new world of the 2020s, particularly demonstrated in Figure 1.

Figure 1 – The major shifts and macrotrends of the 2020s

Source: Bank of America Merrill Lynch (2019)

Accordingly, the three pillars of the G20 summit were ‘empowering people’, ‘safeguarding the planet’ and ‘shaping new frontiers’. This demonstrates the role of intersectional innovation and change across different policy areas, and the need for multi-scalar, multi-stakeholder and multi-sectoral collaboration to instigate the 2020s as a benevolent and transformational decade, even amidst its prospective trepidations.

This article will extrapolate the thoughts and speculations of two experts across two of these pillars, namely ‘safeguarding the planet’ and ‘shaping new frontiers’. For the ‘safeguarding our planet’ expert, I interviewed Laszlo Varro, the Chief Economist of the International Energy Agency (IEA). For the ‘shaping new frontiers’ expert, I interviewed Blanca Anggela Zutta, a programme management specialist at the World Trade Organisation (WTO), with a particular focus on digital innovation. She is also a member of the Stablecoins and CBDC & Monetary Policy Task Force within the Regulatory Group of the Crypto Valley Association (CVA).

Safeguarding the Planet

My interview with Laszlo strongly pertained to energy innovations and megatrends in the fight against climate change. Energy innovations and markets have dramatically shifted in the last 10-15 years, providing important foundations for widespread energy decarbonisation in the next decade and beyond.

The recent IEA Global Energy Outlook Report (see IEA, 2020a) highlights the potential, under various scenarios, for emissions reduction and clean energy to make considerable and rapid progress in combating climate change.

Increasingly, the uptick in global CO2 emissions is stagnating; a trend further driven in the post-COVID world, as can be seen in this IEA (2020a) Figure on CO2 emissions reduction trajectories under various scenarios.

Furthermore, in the pursuit of decarbonisation policies, renewable energy uptake is expected to rapidly increase in capacity this decade, especially as countries continue to pursue a net zero emissions target for 2050. See IEA (2020a) Figure on Sustainable energy adoption projections under various scenarios and IEA (2020a) Figure on the change in global electricity generation by source in the Stated Policies Scenario, 2000-2040. Grey bars indicate the 2000-2019 trend, blue bars indicate the 2019-2040 scenario.

In conjunction with such trends, IEA (2020a) also propagates the rapid rise of energy consumption across emerging markets in the coming decades, particularly in India, Southeast Asia and Africa (see IEA 2020a Figure on the Electricity demand projections for particular regions under Stated Policy Scenarios from 2019-2030). This underscores the importance of expeditious and widespread sustainable energy uptake in the context of the Anthropocene.

In the interview, Laszlo emphasised the significance of hydrogen as an energy product in the pursuit of decarbonisation. He believes hydrogen is one of the most exciting and impactful prospects of energy technology in the next 5-10 years, and is a vital clean energy in an effective and rapid decarbonisation agenda. This is especially due to the investment potential hydrogen has in the context of sustainable finance.

According to Laszlo, hydrogen technology is currently at the same phase in technological innovation and efficacy as solar PV was one decade ago. Considering the exorbitant adoption of solar PV in the previous 10 years, this insinuates much hope for the role of hydrogen in future energy markets and macrotrends.

As stated by Laszlo regarding solar PV:

“The industry was still at small scale…it was still very expensive… a combination of positive factors managed to create an exponential takeoff of PV”.

Quite promisingly, spacecraft and certain vehicles are already using hydrogen in their fuel cells, demonstrating some nascent yet promising success for the energy source. As Laszlo stated, it will be a matter of incremental and gradual changes that leads to mainstream, industrial scale hydrogen being attained en masse.

Indeed, hydrogen technologies could provide 20% of the world’s CO2 abatement and 18% of the world’s final energy demands by 2050 (Potier & Chung, 2020). This is particularly as hard-to-abate sectors can be more easily decarbonised via this fuel, which has zero emissions at the point of use, and can be generated through the use of green energy (Potier & Chung 2020). Across activities such as heavy-duty transportation, industrial heating and heavy-industry feedstock, accounting for approximately 15% of global energy consumption, hydrogen is often the best choice for decarbonisation, and a popular one too (Hydrogen Council, 2020). South Korea even plans to build three hydrogen powered cities by 2022, positioning themselves as a flagship nation in becoming a hydrogen powered society. More broadly, South Korea aims to power 10% of their cities, counties and towns by hydrogen by 2030, growing to 30% by 2040 (Edmond, 2019).

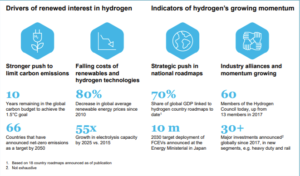

Much of this is capacitated by the economics of hydrogen. The significant scale up of hydrogen production, distribution and manufacturing capabilities and output could decrease the cost of hydrogen by up to 50% by 2030 across a broad remit of applications (Hydrogen Council, 2020). Figure 6 further highlights the economic forces contributing to the economic efficacy and dynamism of hydrogen, and its indicators.

Figure 6 – Economic forces underpinning the economic prospects of Hydrogen as an energy source, and its indicators

Source: Hydrogen Council (2020)

Furthermore, much recent discourse has centred around the role of ‘green’ recoveries from COVID-19. Along this front, the EU recently committed €1.8 trillion to rebuild a Europe beyond the pandemic, with the intention to be a “greener, more digital and more resilient Europe” (European Commission, 2020a). This package offers more than 500 billion Euros to green industries, and is the largest climate change plan in history (Krukowska & Lombrana, 2020).

In France alone, Macron has committed 100 billion Euros to stimulate the French economy, termed the ‘France Re-Launch’ (BBC News, 2020). The investment is equal to 4% of France’s GDP, and has a strong focus on green industry investment and decarbonisation as a co-benefit to mass job creation and economic growth (BBC News, 2020).

Laszlo claimed since the beginnings of the pandemic, discussions around a “systematic integration” of green energy into the economic recovery of the EU have been strong. This is somewhat in alignment with Keynesian economic theory – beckoning governments to stimulate macroeconomic aggregate demand through various means, including infrastructure projects, to grow an economy out of a downturn.

Indeed, even prior to the pandemic, the European Commission was in discussion of a ‘European Green Deal’ strategy; offering a clear framework of regulations and legislation intended to achieve the net-zero 2050 target, and a cut in emissions of 50-55% from 1990 levels by 2030 (Larkin, 2020). Figure 7 highlights some of the aspects of this framework.

Figure 7 – Certain components of the European Green Deal

Source: Larkin (2020)

“I am very happy with the direction the EU is moving” said Laszlo, “we have been arguing all year for governments to put clean energy at the heart of the recovery”.

“Europe is a currently a large importer of fossil fuels, and every year, there is around 60 billion dollars of oil and gas investment…if you put the European economy on a zero carbon trajectory, there will be international trade, there might be clean Hydrogen imported from West Africa, but there will be a much higher level of domestic investment [in renewable energy]”.

Furthermore, Laszlo emphasised the industrial capabilities of Europe in domestically manufacturing many clean energy technologies.

“Europe has strong industrial capabilities in many clean energy areas. There will be imported solar panels…but in wind, in modern grid management technologies, in energy efficiency technologies, in hydrogen technologies, European companies have strong industrial capabilities”.

Despite this, Laszlo does believe more needs to be done in the investment and policy space to set Europe’s energy sector on track for a 2050 net zero emissions target, which he believes it currently will not meet based on current trajectories.

He also emphasised the role the private sector can play in the uptake of many renewable energy areas.

“For certain clean energy technologies, there is a very strong private sector appetite – for offshore wind, for new investments in solar plants, for electric vehicles in the car industry, the private sector can do a lot of the heavy lifting…for the clean energy COVID recovery in Europe, we estimate around ⅔ of total investment can come from the private sector…[however], government funding will have to go areas where private sector funding is insufficient”. Laszlo mentioned how nuclear energy, for example, is one of these areas, particularly given its complex risk profile and contentious reputation.

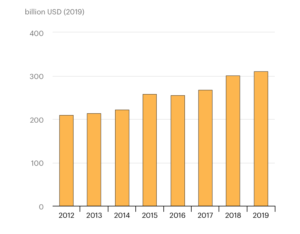

Accordingly, the steady growth of private sector sustainable finance is also a salient and promising megatrend of sustainable energy for the near and distant future (IEA, 2020b). This provides a promising precipice for the rapid decarbonisation necessary in the modern world, as Figure 8 highlights.

Figure 8 – Renewable power investment at constant 2019 costs, 2012-2019

Source: IEA (2020b)

Laszlo strongly emphasised the key role finance and capital markets play in achieving forthright and diligent decarbonisation policies. In particular, there are sizable gaps in sustainable energy investment and innovation in emerging markets, where capital markets and financial institutions are not as well established. This lost opportunity, according to Laszlo, co-exists with the reality that the world does not have access to all the technologies required to fight climate change, despite what is somewhat propagated. It is therefore opportune and necessary to continue rapid innovations and investments, especially via Venture Capital (VC) funders, to avoid complacency and slow downs in the pursuit of green energy uptake.

My final question was a rather loaded one, asking Laszlo if he was hopeful for the future of the planet, particularly amidst the confronting environmental and climate related challenges we face as a species.

“I am”, he responded, “it would be difficult to get out of bed and sit down at my desk and do my daily work if I was not optimistic. The optimism stems from several things. One is technology. While we are very conscious of the need for certain innovations, key technologies like wind and solar are really progressing…I am also optimistic about government policies, including the European Union, China, Japan, and some impressive energy transition COVID plans…we also see a change in broader society…you vote in elections, so you influence the policies of governments, you’re a consumer, so you influence the economy…and you’re also an investor, so you influence the finance sector by your decisions…but it is by no means mission accomplished, so there is a lot of hard work to be done”.

Shaping New Frontiers

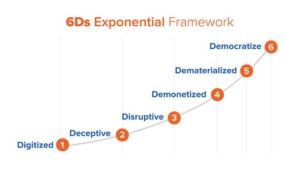

Technology undoubtedly provides various opportunities and challenges for the coming decade. Many of the technological megatrends salient to this decade have been established in the previous one; providing a strong precipice for capacitating our global society.

For an interview on this pillar, I had a conversation with Blanca Anggela Zutta from the WTO, who is a programme management specialist supporting international trade-related capacity building programs.

In particular, Blanca places a strong emphasis on DLT/Blockchain as a key catalyst for technological disruption and change for the near future. This is especially due to its capacity to integrate with other technologies such as the Internet of Things (IoT), Big Data, Virtual Reality (VR), Artificial Intelligence (AI) and Machine Learning (ML). Most notably, much of our discussion focused on the concept of ‘dematerialisation’ through this technology; a concept apparent in the ‘exponential technology’ phenomenon (see Figure 9).

Figure 9 – The 6Ds of Exponential Technologies and Change

Source: Singularity University (2019)

“We are only at the beginning of incredible changes. I have seen very successful and promising projects combining all these other technologies, Blockchain/DLT with AI and IoT…we cannot take one technology and separate it from others, because many times they are interrelated and integrated into solutions responding to a specific issue and supporting a specific SDG”.

Blanca also pointed out the various contexts in which these technologies can be used to optimise outcomes. For example, “…when we talk about supply chains, it is usually Blockchain, IoT and ML techniques, in the finance sector it is usually DLT/AI, in Energy and utilities it is Blockchain and ML, in the entertainment sector it is DLT combined with VR or AI. These special mixes can be powerful and they can have a transformative impact on International Trade”.

Of particular note was our discussion around identity and personal data, and the opportunities and threats Blockchain brings to this matter. One of these areas where blockchain will play a key role is in the recent announcement of the European Central Bank (ECB) announcement of a Central Bank Digital Currency (CBDC) (see European Central Bank, 2020a; European Commission, 2020b). This would be an electronic version of central bank money accessible to residents and citizens of the EU. This is in response to the increasing use of digital payments across the Eurozone; a trend increasingly emulated around the world, as seen in Figure 10 (also see CBDC Tracker.org, 2020).

Figure 10 – Various challenges and opportunities associated with digital payments worldwide.

Source: Auer et. al (2020); CBDC Tracker.org (2020) (sources aggregated and appropriated into image by Blanca Anggela Zutta)

The Eurosystem task force is bringing together experts from the ECB and 19 national central banks to identify scenarios for the implementation and adoption of the European digital currency (European Central Bank, 2020b). These scenarios include the growth in demand for electronic payments, a notable drop in the use of cash and the inception of global private means of payment that raise regulatory concerns and create risks for financial stability and consumer protection, along with the adoption of CBDCs issued by foreign central banks (European Central Bank, 2020b).

CBDCs, or Distributed-Ledger-Technology (DLT) more broadly, is an emerging yet important discourse in central government’s fiscal discussions and policies (see PwC, 2019). Unlike completely decentralised, permissionless cryptocurrency networks, CBDCs are initially issued via permissioned blockchain networks, whereby central banks will have control (PwC, 2019).

Already, there is a growth of CBDCs in the Chinese economy via the newly introduced ‘e-yuan’, currently being piloted (Bray & Tudor-Ackroyd, 2020). It is currently being utilised for more than 1.1 billion Yuan worth of transactions as part of its pilot phase, including the use of it for matters ranging from bill payments, transport usage, government services and more. Additionally, more than 113’300 personal digital wallets and 8’800 corporate digital wallets have been created and used in the e-yuan pilot programmes (Bray & Tudor-Ackroyd, 2020).

“Stablecoins and CBDCs have the potential to transform international trade”, claims Blanca, “increasingly for financial access, digital money instead of cash will accelerate the adoption of digital payments. Digital payments through crypto assets or CBDcs will also make access to financial services more inclusive connecting the unbanked to market opportunities. So the announcement of Libra, followed by the COVID crisis, has put crypto assets and central banks’ CBDCs at the top of the agenda in many countries. There are currently 67 central banks exploring, testing and launching new pilots. First movers in this space could win long-term geopolitical advantage if their CBDCs are adopted broadly.”. Some of the benefits of CBDCs can be seen in Figure 11.

Figure 11 – Some of the Benefits and Uses of an EU CBDC

Source: European Central Bank (2020b)

This provides numerous benefits to the EU, namely real-time understanding of economic activity in a country or region, along with more efficient transactions for consumers and businesses. Additionally, the EU will likely benefit from counter-corruption and laundering practices, due to the enhancement of transaction tracking capabilities (see European Central Bank, 2020; PwC, 2019). However, there are several risks the EU might face through this innovation. Namely, the disintermediation of the banking and finance sector amongst European citizens, which was discussed in an ECB policy paper (see ECB Crypto Assets Task Force, 2019, cited in PwC, 2019 p.1):

“by potentially providing an alternative to some types of bank deposit, CBDC could induce its holders to withdraw a substantial amount of liquidity from the banking system, thereby influencing its ability to finance economic activity in normal times”.

Furthermore, concerns around privacy and consumer data protection laws are commonly communicated. In the EU, the ‘right to be forgotten’ in transactions’ is a focal point of the General Data Protection Regulation (GDPR) law (see European Central Bank, 2020a; European Commission, 2020b; PwC, 2019).

Myself and Blanca ended up discussing the COVID-19 recovery, and the implications innovation has in ‘shaping new frontiers’ in the near future. I posed to Blanca what her biggest hopes and fears are for the future of the global economy in the 2020s.

“Compared to previous economic crises, where governments knew who was involved, how much it will cost, which areas of the economy need to be supported and for how long…with this pandemic, it’s not like that – we don’t have all these parameters. COVID-19 crisis is sending shockwaves that are severely affecting many economies, especially in low-income developing countries (LIDCs)”.

“That’s why we need targeted policy responses”, she continued, “promoting interoperability and harmonised standards, supporting innovation…building capacity in emerging technologies…and better policies for facilitating the uptake of those technologies in international trade, favouring investment in smart cities, and building resilient ecosystems in the next phase that will help us cope with future pandemics”.

Figure 12 highlights the role of various digital innovations in instigating a targeted response to the resilience and recovery from COVID-19.

Figure 12 – The role of various digital innovations in mediating the resilience and recovery of the COVID-19 crisis

Source: Blanca Zutta (2020)

Regarding her biggest excitements and hopes for the 2020s, she said the following:

“My biggest excitement is how the pandemic has reduced barriers for people to connect with each other, and build networks” she stated, “I have never seen before…this hunger for people to connect with each other, to move outside of physical borders, to share ideas, to share best practices, to optimise resources together, and people are more likely to connect outside of where they live, and also change their business to a more integrated business, so they understand solutions come through the exchange of perspectives”.

“This is how creativity and innovation can be cultivated, and also how we can make best use of the limited resources governments have to support their economies, and I think people and companies have understood that, and that’s why they’re moving from classical business models to more integrated business models…where they can develop solutions which integrate with other systems”.

Blanca continued, discussing the role of ‘bottom-up’ transitions and systems in inciting innovation across the world.

“I think there is also a ‘bottom-up’ movement…for collaborative approaches and innovation coming from citizens and start-ups, that can be of strategic interest for governments and international organisations These approaches can lead to collaborations with governmental institutions and international bodies. I also think the future of work will be distributed, with the rise of remote networks, we have seen the democratisation of opportunities and the movement of skills all around the world. In terms of building capacity in developing countries, I have also seen an increase in women’s interest in trade-related online activities than ever before”.

Blanca continued, mentioning the changing expectations of work-life balance and conditions, and the role technology has in facilitating such.

“People now have new expectations about flexibility, working conditions, and life balance; and businesses need to provide the tools through technology to fill those expectations while increasing access to education and training to most vulnerable workers. Giving employees more flexibility can increase gender equality, make companies more inclusive, drive engagement, and build an agile and empowered workforce”.

“I have friends who have been hired in New York without needing to take a plane and live in New York….and contributed to innovative solutions in other countries. Thousands of small business owners still maintain their businesses using video to connect with customers”.

Conclusion

The abhorrent underpinnings of 2020, and the adverse emergence of this new decade, create more questions than answers about the nature of humanity and the world. As a society, humanity has been awakened from its apathetic contentment, with a widespread understanding of the fragility of our species and civilisation becoming incredibly pertinent. Hence, we now have the dawn of a new decade to instigate change in response to these new understandings. The results of the G20 summit will be a dress rehearsal of sorts for this; particularly the multilateral potential for creating a more sustainable, just and resilient world moving forward.

The interviews with Laszlo and Blanca were some great insights into how we might achieve such, especially in regards to the pillars of the G20 Summit. Most notably, innovation and disruption were key themes of our discussions, and demonstrates the salience and necessity of such forces to achieve a better world.

It is now a matter of time and effort to see if such promising prospects can manifest in reality. This decade is the ultimate testing ground for the world, and hopefully, we pass its final exam.

References

Anggela Zutta, B., (2020). Targeted responses need to address different phases of the COVID-19 shock, Geneva Trade Week.

Auer, R., Cornelli, G., Frost, J. (2020). Rise of Central Bank Digital Currencies Drivers, Approaches and Technologies. Bank for International Settlements. https://www.bis.org/publ/work880.pdf.

Bank of America Merrill Lynch (2019). Transforming the World: The 2020s. https://resiliencesystem.org/sites/default/files/Decade_of_Peaks.pdf

BBC News. (2020, September 3). France in huge coronavirus recovery plan focusing on green energy. BBC News, https://www.bbc.com/news/business-54009642 .

Bray, C & Tudor-Ackroyd, A (2020). People’s Bank of China’s Digital Currency Already Used for Pilot Transactions Worth 1.1 Billion Yuan. https://www.scmp.com/business/banking-finance/article/3104281/peoples-bank-chinas-digital-currency-already-used-pilot

CBDC Tracker.org (2020). http://cbdctracker.org/.

European Central Bank (2020a). ECB intensifies its work on a digital euro. https://www.ecb.europa.eu/press/pr/date/2020/html/ecb.pr201002~f90bfc94a8.en.html

European Central Bank (2020b). Report on a Digital Euro. https://www.ecb.europa.eu/pub/pdf/other/Report_on_a_digital_euro~4d7268b458.en.pdf

European Commission (2020a). Recovery Plan for Europe. https://ec.europa.eu/info/strategy/recovery-plan-europe_en#the-largest-stimulus-package-ever

European Commission (2020b). Regulation of the European Parliament and of the Council on Markets in Crypto-Assets, and Amending Directive. https://eur-lex.europa.eu/resource.html?uri=cellar:f69f89bb-fe54-11ea-b44f-01aa75ed71a1.0001.02/DOC_1&format=PDF

Hydrogen Council (2020). Path to Hydrogen Competitiveness: A Cost Perspective. https://hydrogencouncil.com/wp-content/uploads/2020/01/Path-to-Hydrogen-Competitiveness_Full-Study-1.pdf

International Energy Agency (2020a). World Energy Outlook 2020. https://www.iea.org/reports/world-energy-outlook-2020/outlook-for-electricity#abstract

International Energy Agency (2020b). World Energy Investment 2020. https://www.iea.org/reports/world-energy-investment-2020/power-sector#trends-in-renewable-power-costs-and-investments

Krukowska, E., Lombrana, L (2020, July 21). EU Approves Biggest Green Stimulus in History with $572 Billion Plan. Bloomberg Green. https://www.bloomberg.com/news/articles/2020-07-21/eu-approves-biggest-green-stimulus-in-history-with-572-billion-plan

Larkin, M. (2020, May 14). The European Green Deal must be at the heart of the COVID-19 recovery. World Economic Forum. https://www.weforum.org/agenda/2020/05/the-european-green-deal-must-be-at-the-heart-of-the-covid-19-recovery/

Potier, B., Chung, E. (2020, January 31). A Clean Energy Future With Hydrogen Could Be Closer Than We Think. World Economic Forum. https://www.weforum.org/agenda/2020/01/a-clean-energy-future-with-hydrogen-could-be-closer-than-we-think/

PwC (2019). The Rise of Central Bank Digital Currencies: What You Need To Know. https://www.pwc.com/gx/en/financial-services/pdf/the-rise-of-central-bank-digital-currencies.pdf

Singularity University (2019). Incremental to Exponential: How to Read Your Growth Engine’s Warning Lights. https://su.org/blog/how-to-read-growth-engine-warning-lights/

The ’Ndrangheta’s Infiltration and Threat to European Institutions

The ’Ndrangheta’s Infiltration and Threat to European Institutions  From Paper to Practice: How Grassroots Norms Undermine Gender Rights in Pakistan

From Paper to Practice: How Grassroots Norms Undermine Gender Rights in Pakistan  Exploited Childhoods: The Role of Global Corporations in Perpetuating and Mitigating Child Labour

Exploited Childhoods: The Role of Global Corporations in Perpetuating and Mitigating Child Labour  Human Rights Challenges in Addressing SLAPPs in Media, NGOs and Journalism in the EU

Human Rights Challenges in Addressing SLAPPs in Media, NGOs and Journalism in the EU