Written by: Fabio Ashtar Telarico

Edited by: Carla Posch

Executive Summary

As the Euro will soon turn 25 years old, the European Central Bank (ECB) is preparing a cosmetic makeover to improve European relations with the common currency. But much more invasive interventions are needed to secure the Euro’s future.

Against this background, this policy brief explores the relationship between monetary integration and the EU’s political future, focusing on Bulgaria’s lukewarm support for the Euro. It argues that the Euro is not just an economic project but a deeply political one, urging pro-EU policymakers to understand and engage with the political dimensions of the Euro project. The brief emphasises the need to correct the political representation and perception of the Euro, suggesting that its depoliticisation has obscured the political choices involved in sharing monetary sovereignty. It encourages pro-EU forces to reclaim the language of sovereignty from populist parties and rethink how they express the view that the Euro is a cornerstone of a more integrated and politically cohesive Europe. Furthermore, it calls for reframing the Euro in terms of an exercise of popular sovereignty that enhances Europe’s collective strength and global autonomy.

To sustain and strengthen the Euro project, the brief recommends a series of measures aimed at enhancing the Euro’s governance to foster a more inclusive discourse on the common currency’s role in European integration. These include:

- Acknowledging that wealthier and more powerful countries have benefited disproportionately from the Euro until now, but noting that it must not continue to be in this way and that the Euro can be reformed;

- Reframe the narrative around the Euro as a tool of shared popular sovereignty through a renewed engagement in a broad dialogue with voters, Euro-sceptic oppositions, and other stakeholders;

- Opening the door to reforms of the Euro”s governance, including a double mandate that would ensure the ECB cannot undermine national fiscal policies.

1. Introduction

The adoption of the Euro is undoubtedly one of the most tangible signs of continued European integration. Thus, EU institutions and pro-EU political actors forget their usual willingness to compromise when it comes to this issue. In fact, the insistence on as many member states as possible to eventually adopt the common currency led to the introduction of a mandate with the 1992 Maastricht Treaty. At the same time, Europeanists ostensibly dismiss Euroisation as a merely “technical” issue and attempt to depoliticise it. Indeed, “[d]epoliticising the integration process has served the pro-Europeans well as long as they could get away with it” (Kriesi, 2016, p. 33). But voters have become more resistant to such strategies ever since the Great Recession and the ensuing sovereign-debt crisis.

Thus, insistence of depoliticisation is making the common currency increasingly unpopular across the Union. Metaphorically, it has turned the Euro into a sword of Damocles wielded by faceless bureaucrats over the poorer Eastern-European member states. Moreover, pushing the common currency out of the political arena preempts democratic debate on pressing issues. Ultimately, this dogmatism weakens the EU’s very ability to evolve into a genuinely popular, democratic, and economically vital social system.

Rethinking the connections between democracy and monetary sovereignty is key to the EU’s democratisation and for pro-EU forces’ success. But it cannot be achieved without the willingness to admit that adopting the common currency is a political decision. And, as such, it cannot be remitted to grey academic economists eschewing open debate. Rather, it must be consciously taken by a popular majority. Policymakers and their staff can learn much from the ongoing debate on Bulgaria’s adoption of the Euro. In the last few years, establishment parties have adopted a rhetoric that shows all the hallmarks of depoliticisation in order to accelerate Euroisation. In the process, they left anti-establishment “populist” as the only ones able to wield the language of popular (and monetary) sovereignty. Thus, Bulgaria offers a privileged viewpoint on the dogmatic belief system because of which pro-EU political subjects push for euroisation everywhere as soon as possible – while depicting all those who may disagree as extremists.

As the Bulgarian public becomes increasingly alienated from both old and new pro-EU parties and steadily loses faith in the Euro, this debate offers a chance to change course. By rediscovering the lexicon of sovereignty and learning from the Euro’s apparent failure in Bulgaria, European policymakers have a chance to correct decades of political mistakes. On the way, they will also get a chance to fix a monetary regime that perpetuates inequalities despite the Union’s ambition to reduce them.

2. Background: A Refresher on sovereignty, currencies, and democracy

Given the depth of integration within the EU, even supporters of depoliticisation may find it very hard to maintain that state sovereignty has gone unscathed. True, some academics have gone to unwarranted lengths to argue that sovereignty is not lost, but rather “reshaped” (e.g., Saurugger, 2013). Not to mention the banal, yet pungent argument that since “it was created through voluntary agreements among its Member States” the EU “is a product of state sovereignty” (Škrbić and Imamović, 2017, p. 318). In other words, EU member states remain sovereign – or, anyway, no less sovereign than any other country faced with “globalisation” (as Jessop, 2004/2013 argues more broadly). Thus, there should be no need to worry about sovereignty: While modes of exercises may have changed, its substance remains.

2.1 Sovereignty: A necessary, but not sufficient condition of democracy

However, over the last decades, the notion of sovereignty has been subject to systematic political instrumentalisation. Insurgent “populist” parties use it so often that it seems to be the only thing that matters whereas establishment forces use “sovranist” as a pejorative label for rightist political subjects (cf. the usage and references in Pasquino and Valbruzzi, 2019a; 2019b).

This has led to a mesmerising inability to articulate its meaning in a constructive way. As well as to the inability, for many pro-EU politicians, to speak the language of sovereignty (cf. the discourse analysis in Braun, 2008 and the media analysis in Sándor, 2023) on which democracy is built.

2.2 Monetary sovereignty and the democratic problem with delegation of powers

It is apparent that as the EU acquires greater competencies, decision-making power filters through ever more levels of supranational governance (Brandsma, 2015). Crucially, each of these layers adds a degree of opaqueness given that they operate mostly behind closed doors prejudicing democratic legitimacy and accountability (Türk, 2015). As a result of the often overlooked intersection between sovereignty and democracy, state sovereignty in the EU has morphed in radical ways. And nowhere has state sovereignty changed beyond recognition as much as in monetary affairs.

At this point, one might argue that: Provided that monetary sovereignty is transferred by legitimate governments, state sovereignty not undermined. But this is line of argumentation has three main flaws:

- it “is limited to state money and state action” (Pistor, 2017, p. 495), thus ignoring the role that multinationals and international organisation can and do play;

- it fails to realise that “public and private moneys are part of an integrated, hierarchical money system, both domestically and globally” (Pistor, 2017, p. 496);

- it ignores that elected officials cannot always delegate the power they exercise in voters’ name without the latter’s explicit authorisation.

Admittedly, the first two points are rather technical and exploring them in detail goes beyond the scope of this article. However, the third one is probably the most important and much easier to explore. In brief, all the apparatuses of a democratic state exercise their powers in the name and on behalf of the people. Thus, relinquishing this power to a third entity may constitute an unconstitutional delegation – which “is unquestionably a fundamental element of [the] constitutional system” (Lawson, 1999, p. 24) in the US and many EU countries (cf. references in Schütze, 2011). Ultimately, the electoral body is the only authority that could delegate monetary sovereignty in a truly democratic political regime. It can easily do so even in a liberal system through existing instruments of direct democracy – like, for instance, referendums.

In this perspective, the Euro’s depoliticisation and top-down adoption make it a poster-child of the neoliberalism of the 1990s, which aimed at “weakening and dislocating popular sovereignty […], its expression in participation and deliberation, thereby provoking anger and mistrust toward elites and institutions.” (Herzog, 2021, p. 2)

3. The debate on Euroisation in Bulgaria: Lessons on the failure of depoliticisation

Against this background, the debate on the Euro’s adoption in Bulgaria provides a prime-time overview of pro-EU elites’ refusal to discuss the intrinsically political nature of the common currency openly. Indeed, the rejection of any critique of the Euro testifies to an acute awareness of the weakness of the project’s unpopular “neoliberal agenda” (Arestis and Sawyer, 2002, p. 1). Economically, denying that the Euro is far from an optimal currency area (Coudert et al, 2013) hollows out national economic policy and fosters asymmetries between fiscal and monetary stances (Arestis and Sawyer, 2002, p. 5).

However, most of the public discourse refuses to acknowledge or even legitimise any of these issues, blaming “insufficient information” (Todorov, 2023; Goranov, 2020). This behaviour has not gone unnoticed in the, ever fewest, opposition media in the country (e.g., Volgin, 2022). Hence, the refusal to take stake in the Euro project’s fragility and insisting on depoliticisation empowers so-called populist forces.

3.1 How depoliticisation feeds grassroot resistance

Attempts at depoliticising the Euro are leading to the opposite outcome in Bulgaria. In fact, only Revival’s (Vazrazhdane in Bulgarian) 34 MPs took a clearly sceptical view of the common currency (see Veselinova, 2024). Meanwhile, ITN’s – founded by popular showman and folk singer Slavi Trifonov – 11 deputies raised circumstantial oppositions against the immediate entry in the Eurozone, but they dare not argue against the euro tout court (see Karimanski, 2024). But 191 of the 240 MPs are affiliated with parties that support adopting the euro as soon as possible: the former-communist Bulgarian Socialist Party, the conservative GERB, and the centre-right PP-DB, and the moderate DPS (see Ninova, 2024; RFE/RL, 2023).

And, the leaders of pro-EU (and pro-Euroisation) parties have declared that “the Euro is a Bulgarian currency” (Petkov in NS, 2023) or that “de facto the whole economy runs on euros” (Vasilev in Ivanov, 2024). Rather than arguments, these statements resemble descriptions of an inevitable outcome because there is no alternative, as Margareth Thatcher used to say (Robinson, 2013).

The impression that there is no room for debate emerges also from the largely uncontested use of a carrot-and-stick style communication. On the one hand, there are unceasing announcements that “adopting the Euro will not lead to prices raise” (Vasilev in Valchanova, 2024), with the Euro “Bulgaria will become richer” (Galubinov in Todorov, 2023) and “everyone will live better” (Dencheva, 2023). On the other hand, some went so far as menacing that “either we adopt the Euro, or we are stuck in the trash can” (Vasilev in Gergov, 2022). Such speeches and interviews evoke memories of the failed “Remain” campaign in the UK and its “Project Fear”: instilling fear into voters by claiming that breaking with the pro-EU course is economically risky (Spence, 2016).

In the meantime, doubtful voters are held in contempt as “citizens with a higher socio-economic status understand the benefits of [the Euro’s] introduction, [… t]he rest of the population needs to be worked on more” (Kitipov in Todorov, 2023). More generally speaking, amongst the Bulgarian political elite and intelligentsia, it is commonplace to believe that voters cannot be trusted to decide about the Euro because laymen are “afraid [of] what they do not understand” (Nedev, 2020). In a renewed form of paternalism, voters become a scared flock in need of guidance rather than the prime source of all political power and the ultimate beneficiary of its exercise.

3.2 Misconceiving monetary sovereignty: The issue of the monetary board

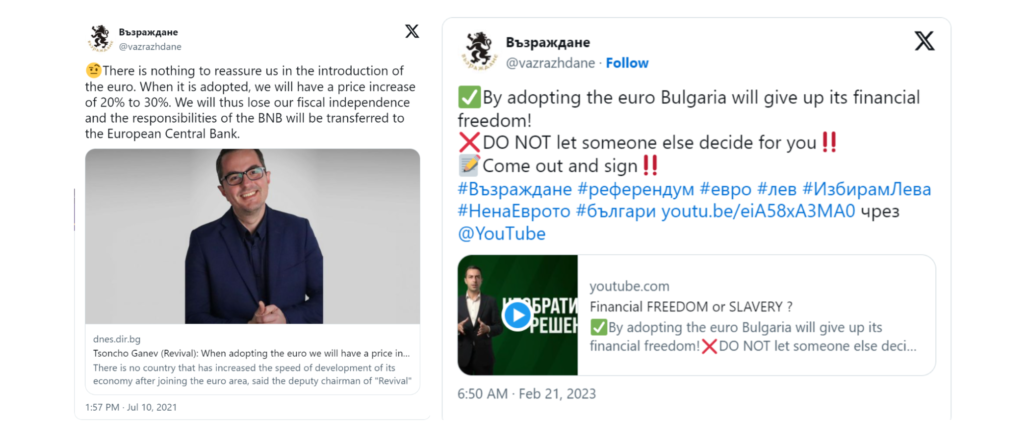

One of the opposition’s main arguments against adopting the Euro is the implicit loss of sovereignty (Figure 1):

Figure 1 Social-media posts from Revival’s official account on the Euro’s meaning for monetary sovereignty on X (formerly Twitter [left, right]).

Indeed, the main reason why political and opinion leaders usually attempt to depoliticise the Euro is to gloss over this (potential) loss of sovereignty. Instead, Bulgarian pro-EU actors have attempted a new approach. Rather than ignore this issue, they argue that de facto Bulgaria has already renounced its monetary sovereignty. Thus, it should adopt the common currency as soon as possible (e.g., Yotsov, 2022).

By and large, this position is based on a misunderstanding of Bulgaria’s monetary policy and the meaning of monetary sovereignty.

In fact, saying that this implies Bulgaria has already ceded its monetary sovereignty to the ECB is factually wrong. states are monetary sovereign if they can use monetary leverages and act as a lender of last instance to all economic actors, including themselves (cf. Pistor, 2017, p. 496). The adoption of a monetary board is a sovereign decision that the voters and their representatives can revoke at any time. In contrast, it is highly likely that, especially for smaller economies, there is no way out of the Euro that does not irremediably compromise the economy (Realfonzo and Viscione, 2015). Therefore, equating a monetary board with a common currency is just a new way to depoliticise the Euro: Misrepresenting a new policy as the unavoidable continuation of a reversible status quo.

3.3 Euro adoption as a straitjacket on sovereignty

By demanding an open debate and speaking out on the common currency’s functioning, the Eurosceptic Revival is winning over voters’ trust (Kostadinov, 2023). Furthermore, the party has provided a platform for nonpartisan economists who make the case for the Euro causing price hikes (Vuldzhev, 2023) or the ECB playing favourites (Sapunarov, 2023). It also claims the moral high ground of being more open to discussions than its pro-EU opponents. Additionally, Revival collected over 600,000 signatures for a referendum on Euroisation (DW, 2023). According to the Law on citizens’ direct participation in state government and local self-government, the Parliament must approve referendum requests bearing at least 400,000 signatures (NS, 2009/2022, art. 10, para. 2). But the pro-EU majority shied away from this obligation (DW, 2023) and even packed, possibly unconstitutionally (Kiselova, 2024), the Constitutional Court to ensure no remedy would be granted (Veselinova, 2024).

Figure 2 Voting intention for the main Bulgarian parties (Author’s elaboration on Europe Elects data)

Possibly, the most illuminating step in this sequence of events is the justification for this court decision. In fact, the Court wrote no more than 40 pages, most of which filled with content that is not substantively related to the issue at hand: the history of the EU’s legal integration and the meaning of “accepting” or “not accepting” a referendum (Volgin et al, 2024). Eventually, it concurred with the Supreme Bar Council’s amicus brief that “in no case and in no way, may the Parliament’s right to make a substantive judgement be restricted” by popular will (BAS, 2023, p. 4). Exactly this sort of argument suggests that the Euro is a tool to constrain allegedly irresponsible political forces and even popular sovereignty. In the words of Professor Plamen Kirov, constitutional scholar and former constitutional judge, “something rather dangerous” lies “between the lines” of that decision: “the understanding […] that the parliament is not obliged to decide to hold any referendum, no matter how many signatures are collected.” (Kirov, 2024). Such an idea is not exclusive to the Bulgarian debate. Rather, similar reasons came up in Italy in the runup to the Euro’s creation in the late-1990s (Giurlando, 2015, p. 29). Practically, it seems that the current approach to Euroisation consists of a form of straitjacketing of state sovereignty.

4. Policy recommendation

With its peculiar mix of a fractured political establishment, a weak economy, and a widely disillusioned electorate, Bulgaria poses a new challenge to the Euro project. According to all surveys published up to the time of writing (April 2024), no matter how the question is asked, about half of Bulgarians wish for their country not to adopt the Euro, and the trend is towards increasing polarisation on this issue (Figure 3).

Figure 3 Opinion on the adoption of the Euro in Bulgaria (Author’s elaboration on Gallup data)

For pro-EU forces, these signals must turn into a wake-up call. Having left the language of sovereignty to anti-establishment “populist” forces, many political leaders cannot articulate their message in a credible way. Despite the attempt at developing new rhetoric tools to depoliticise the common currency, this path is becoming increasingly unviable. Rather, it is time that Europeanists re-learn and rediscover the lexicon of popular sovereignty and democracy. On this path, the mainstream approach to the Euro and Euroisation of Eastern-European countries should evolve by adopting three strategies:

A) Open a debate on whether the Euro has benefited richer countries more

Only frankness on how the Euro has failed to deliver on some of its promises can restore voters’ confidence in the project. For instance, it is time to stop pretending that weak economic systems like Bulgaria’s will suddenly improve by joining the eurozone. Especially given that the common currency has worsened inequalities “through exchange-rates misalignments that have been larger and more persistent in peripheral countries” (Coudert et al, 2013, p. 35). In addition, the Euro’s current construction make it the “most vulnerable to the volatility shocks of the German and French real exchange rate” and ensures it functions mostly as a currency of wealthy European countries, which “influence more the nominal exchange rate of the Euro” (Nikas et al, 2019, p. 645).

B) Recognising that adopting the Euro means sharing popular sovereignty

Once an open debate begins, new tools have to be put in place to ensure that the Euro is adopted not in spite of, but in agreement with popular sovereignty. In this sense, pro-EU parties should reconsider the efforts to describe referendums as plebiscites in which voters ought to take choices that are too complex for them to fully grasp. Empirically, this paternalistic view is incompatible with the reality of voters who

are smarter than they are often given credit for [… because t]hey may not be fully informed about European politics, but they do consider the issues at stake before they go to the ballot box and they make use of the information provided by parties and the campaign environment. Voters are thus more competent than commonly perceived.

(Hobolt, 2009, p. 5)

Probably, the failure of the two referendums ever organised on the Euro (Demark in 1992 and Sweden in 1995) prompted this quest to sidestep popular will. Rather, they should indicate that there is something in how the common currency works that does not persuade even highly educated and well-off citizens in Northern Europe.

C) Listen to voters’ concerns a double mandate for the ECB

A comprehensive reform of the common currency, including the neoliberal institutional principles governing the ECB, should be a priority. For instance, there should be a debate on how the mandate to focus on inflation can work contrary to national fiscal policies that target full employment (Arestis and Sawyer, 2002, p. 5). Such concerns do not encumber the US Federal Reserve or other central banks that have a dual-mandate: caring for inflation and unemployment at the same time (Kallianiotis and Petsas, 2020). Thus, as already suggested by several scholars, the “extensive independence of the ECB should be challenged to better match the international standards in this area” (Blot et al., 2014, p. 172) by establishing a similar “double mandate”.

5. Conclusion

In conclusion, the journey towards a more integrated Europe, underpinned by the adoption of the Euro, has been both ambitious and fraught with complexities. The Euro ushered in significant economic benefits, including increased trade, investment flows, and financial stability across the Eurozone. However, the path has also been marred by economic disparities, fiscal policy dilemmas, and numerous crises that have tested the resilience of the Euro’s governance.

As the common currency turns 25, the Euro project remains a key pillar of European integration. It represents a commitment to not only economic unity, but also to the political vision of a more integrated and cohesive Europe. Unfortunately, its inception was embedded in a neoliberal agenda that has lost traction with voters across the Old Continent. The experience of the current debate in Bulgaria should be a stepping stone towards realising a more resilient, prosperous, and united Eurozone by reforming the ECB and recognising the need for a more transparent debate on the common currency. Addressing these issues requires not just political hindsight but also a recommitment to the political ideals underpinning the common European house: heartfelt solidarity, authentic democracy, and shared prosperity.

References

Arestis, P., & Sawyer, M. (2002). European Integration and the “Euro Project” (Archives of the Levy Economics Institute, pp. 1–7) [Policy note]. Levy Economics Institute at Bard College. https://digitalcommons.bard.edu/levy_archives/84

BAS. (2023). Становище на Висшия адвокатски съвет по конституционно дело № 13/2023 г. [Opinion of the Supreme Bar Council on Constitutional Case № 13/2023]. Vish advokatski sŭvet. https://www.vas.bg/p/s/t/stanovishte-kd-13-2023-13021.pdf

Blot, C., Creel, J., Hubert, P., & Labondance, F. (2014). Dealing with the ECB’s triple mandate? Revue de l’OFCE, 134, 163.

Brandsma, G. J. (2015). Comitology: Over 50 Years of Institutional Reforms and Emerging Practices. In M. W. Bauer & J. Trondal (Eds.), The Palgrave Handbook of the European Administrative System (pp. 419–431). Palgrave Macmillan UK. https://doi.org/10.1057/9781137339898_24

Braun, M. (2008). Talking Europe—The Dilemma of Sovereignty and Modernization. Cooperation and Conflict, 43(4), 397–420. https://doi.org/10.1177/0010836708096882

Clifton, J. (2014). Beyond Hollowing Out: Straitjacketing the State. The Political Quarterly, 85(4), 437–444. https://doi.org/10.1111/1467-923X.12123

Coudert, V., Couharde, C., & Mignon, V. (2013). On Currency Misalignments within the Euro Area. Review of International Economics, 21(1), 35–48. https://doi.org/10.1111/roie.12018

Dencheva, R. (2023, September 5). Заедно и без колебание “за” еврото – власт, бизнес и синдикати: Всеки ще живее по-добре [Together and without hesitation for the euro – government, business and trade unions: everyone will live better]. 24 Chasa. https://www.24chasa.bg/biznes/article/14417273

Dyzenhaus, D. (1999). Friend and Enemy: Schmitt and the Politics of Law. In D. Dyzenhaus (Ed.), Legality and Legitimacy: Carl Schmitt, Hans Kelsen, and Hermann Heller in Weimar. Oxford University Press. https://doi.org/10.1093/acprof:oso/9780198298465.003.0002

- (2023, July 7). Парламентът отхвърли референдума за еврото [Parliament rejects referendum on the euro]. Deutsche Welle. https://www.dw.com/bg/parlamentt-othvrli-referenduma-za-evroto/a-66155772

Gergov, I. (2022, December 6). Или приемаме еврото, или оставаме на боклука [Either we adopt the euro or we are stuck in the trash can]. News.bg. https://news.bg/economics/nikolay-vasilev-ili-priemame-evroto-ili-ostavame-na-bokluka.html

Giurlando, P. (2015). Italy and the Euro: Expectations versus Results. Mediterranean Quarterly, 26(3), 29–48.

Herzog, A. (2021). The Attack on Sovereignty: Liberalism and Democracy in Hayek, Foucault, and Lefort. Political Theory, 49(4), 662–685. https://doi.org/10.1177/0090591720958124

Hobolt, S. B. (2009). Europe in Question: Referendums on European Integration. Oxford University Press. https://doi.org/10.1093/acprof:oso/9780199549948.001.0001

Ivanov, P. (2024, February 5). В България де факто цялата икономика работи с евро [‘In Bulgaria de facto the whole economy runs on euros]. Actualno.bg; https://www.actualno.com. https://www.actualno.com/finance/asen-vasilev-pred-tagesshpigel-v-bylgarija-de-fakto-cjalata-ikonomika-raboti-s-evro-news_2152642.html

Jessop, B. (2013). Hollowing out the ‘nation-state’ and multi-level governance. In A Handbook of Comparative Social Policy (2nd ed., pp. 11–26). Edward Elgar Publishing. https://www.elgaronline.com/edcollchap/edcoll/9781849803663/9781849803663.00008.xml (Original work published 2004)

Kallianiotis, I. N., & Petsas, I. (2020). The Effectiveness of the Single Mandate of the ECB and the Dual of the Fed. Journal of Applied Finance & Banking, 10(4). https://econpapers.repec.org/article/sptapfiba/v_3a10_3ay_3a2020_3ai_3a4_3af_3a10_5f4_5f11.htm

Karimanski, L. (2024, January 21). Не може да влезем в еврозоната в средата на годината, няма такава практика е ЕС [We cannot enter the euro area in the middle of the year, there is no such practice in the EU] [24 Chasa]. https://www.24chasa.bg/biznes/article/16869862

Kirov, P. (2024, February 10). В решението на КС прозира нещо опасно—Никога да не проведем национален референдум [There is something dangerous in the CC decision—Never to hold a national referendum] (P. Volgin, Interviewer) [Bulgarsko Natsionalno Radio]. https://bnr.bg/post/101947356

Kiselova, N. (2024, January 26). Може и двете решения да са противоконституционни [Both rulings may be unconstitutional] [bTV]. https://btvnovinite.bg/bulgaria/doc-kiselova-za-novite-sadii-v-ks-mozhe-i-dvete-reshenija-na-ns-da-sa-protivokonstitucionni.html

Kostadinov, K. (2023, January 11). Костадинов: Изходът от политическата криза са нови избори [The way out of the political crisis is new elections] [Nova Televizia]. https://nova.bg/news/view/2023/01/11/397165/костадинов-изходът-от-политическата-криза-са-нови-избори

Kriesi, H. (2016). The Politicization of European Integration. JCMS: Journal of Common Market Studies, 54(S1), 32–47. https://doi.org/10.1111/jcms.12406

Lawson, G. (1999). Delegation and the Constitution. Regulation, 22(2), 23–32.

Nedev, S. (2020, February 3). Евро или не? [Euro or not?]. Konservatora. https://conservative.bg/evro-ili-ne/

Nikas, C., Stoupos, N., & Kiohos, A. (2019). The Euro Area: Does one currency fit all? International Review of Applied Economics, 33(5), 642–658. https://doi.org/10.1080/02692171.2018.1516742

Ninova, K. (2022, May 30). БСП не е срещу еврото, но да видим първо анализите [BSP is not against the euro, but let’s see the analysis first] [bTV]. //btvnovinite.bg/bulgaria/ninova-bsp-ne-e-sreshtu-evroto-no-da-vidim-parvo-analizite.html

- (2023, April 12). Стенограми от първото заседание на 49то НС [Transcripts of the first session of the 49th National Assembly]. Народно събрание на Република България. https://www.parliament.bg/bg/plenaryst

Pasquino, G., & Valbruzzi, M. (2019a). Sovereignty in the Italian polling booths. Journal of Modern Italian Studies, 24(5), 641–647. https://doi.org/10.1080/1354571X.2019.1681682

Pasquino, G., & Valbruzzi, M. (2019b). The 2019 European Elections: A ‘second-order’ vote with ‘first-order’ effects. Journal of Modern Italian Studies, 24(5), 736–756. https://doi.org/10.1080/1354571X.2019.1681706

Pistor, K. (2017). From Territorial to Monetary Sovereignty. Theoretical Inq. L., 18, 491. https://doi.org/10.1515/til-2017-0022

Realfonzo, R., & Viscione, A. (2015). The Real Effects of a Euro Exit: Lessons from the Past. International Journal of Political Economy, 44(3), 161–173. https://doi.org/10.1080/08911916.2015.1095044

RFE/RL. (2023, July 26). В Шенген до края 2023 г. И в еврозоната до 2025 г. Правителството прие програма за управление [In Schengen by the end of 2023 and in the euro area by 2025 The government adopted a governance programme]. Svobodna Evropa. https://www.svobodnaevropa.bg/a/pravitelstvo-plan-upravlenie/32520945.html

Robinson, N. (2013, March 7). There is no alternative (TINA) is back. BBC News. https://www.bbc.com/news/uk-politics-21703018

Sándor, F. (2023). Sovereignty-based euroscepticism. Multidiszciplináris Tudományok, 13(3), Article 3. https://doi.org/10.35925/j.multi.2023.3.6

Sapunarov, T. (2023, January 31). Еврозоната противоречи на идеята на ес за обединение на народите [The eurozone contradicts the EU’s idea of uniting nations] [Bulgarsko Natsionalno Radio]. https://bnr.bg/vidin/post/101772095/todor-sapunarov-ikonomist-vavejdaneto-na-evroto-shte-e-pagubno-za-ikonomikata-ni

Saurugger, S. (2013). Is there a sovereignty problem in the EU? (Working Paper 9; Sciences Po Grenoble Working Paper, pp. 1–29). Sciences Po Grenoble. https://shs.hal.science/halshs-00911482

Schmitt, C. (2007). The Concept of the Political: Expanded Edition (Leo Strauss, Ed.; G. Schwab, Trans.). University of Chicago Press. https://press.uchicago.edu/ucp/books/book/chicago/C/bo5458073.html (Original work published 1933)

Schütze, R. (2011). ‘Delegated’ Legislation in the (new) European Union: A Constitutional Analysis. The Modern Law Review, 74(5), 661–693. https://doi.org/10.1111/j.1468-2230.2011.00866.x

Škrbić, A., & Imamović, M. F. (2017). The Sovereignty of the Member States of International Organizations with Special Focus on European Union. EU and Comparative Law Issues and Challenges Series (ECLIC), 1(1), 309–320. https://doi.org/10.25234/eclic/6534

Spence. (2016, February 26). David Cameron unleashes ‘project fear.’ POLITICO. https://www.politico.eu/article/david-cameron-brexit-project-fear-economy-jobs-terror-warning-britain-leaves-eu/

Telarico, F. A. (2022). Bulgarians’ fight against inflation: A case study in economics’ (poor) understanding of post-socialism. LAP LAMBERT Academic Publishing.

Todorov, K. (2023, September 5). България ще стане по-богата с еврото [Bulgaria will become richer with the euro]. Fakti. https://fakti.bg/bulgaria/812949-eksperti-balgaria-shte-stane-po-bogata-s-evroto

Türk, A. H. (2015). Comitology. In D. Chalmers & A. Arnull (Eds.), The Oxford Handbook of European Union Law (p. 0). Oxford University Press. https://doi.org/10.1093/oxfordhb/9780199672646.013.15

Valchanova, Z. (2024, January 19). Приемането на еврото няма да повиши цените [Adopting the euro will not raise prices]. Investor.bg. https://www.investor.bg/a/516-politika/387852-asen-vasilev-priemaneto-na-evroto-nyama-da-povishi-tsenite

Veselinova, M. (2024, February 8). Референдум за еврото няма да има [There will be no referendum on the euro]. Kapital. https://www.capital.bg/politika_i_ikonomika/pravo/2024/02/08/4586017_referendum_za_evroto_niama_da_ima/

Vladislav Goranov. (2020, February 22). Интервю на министър Владислав Горанов за предаването “Карай направо” [Interview of Minister Vladislav Goranov for the programme “Drive Straight”] [Nova Televizia]. https://www.minfin.bg/bg/media/10956

Volgin, P. (Director). (2022, October 29). От еврото и оръжията печелят само елитите [Only the elites benefit from the euro and weapons]. In Politicheski NEkorektno. Bulgasko Natsionalno Radio. https://bnr.bg/horizont/post/101728229/komentar-na-petar-volgin-ot-evroto-i-orajiata-pechelat-samo-elitite

Volgin, P., Androlova, K., & Apostolov, V. (2024, October 2). Карлсън и Путин [Carlson and Putin]. https://binar.bg/politicheski-nekorektno-s-petar-volgin-ot-10-02-2024/

Vuldzhev, G. (2023, September 26). Въвеждане на еврото в България от началото на 2025 г. – Риск или икономическа перспектива [Introduction of the euro in Bulgaria from the beginning of 2025—Risk or economic perspective] (E. Marinova, Interviewer) [Investor.bg]. https://www.investor.bg/a/515-ikonomika-i-makrodanni/381719-vavezhdane-na-evroto-v-balgariya-ot-nachaloto-na-2025-g-risk-ili-ikonomicheska-perspektiva

Yotsov, V. (2022, June 28). Губи ли България суверенитет, ако приеме еврото? [Does Bulgaria lose sovereignty if it adopts the euro?] (M. Petrova, Interviewer) [Bulgarsko Natsionalno Radio]. https://bnr.bg/factcheck/post/101667902/balgaria-nama-da-zagubi-suvereniteta-si-ako-prieme-evroto

Закона За Пряко Участие На Гражданите в Държавната Власт и Местното Самоуправление [Law on Direct Participation of Citizens in State Power and Local Self-Government] (2009 and 2022). Ann. SG 44 of 12 June 2009. https://lex.bg/bg/laws/ldoc/2135636485

Towards sustainable supply chains: Opportunities and Obstacles to Corporate Due Diligence in the EU

Towards sustainable supply chains: Opportunities and Obstacles to Corporate Due Diligence in the EU  The Israel-Palestine Conflict and South Africa’s case against Israel before the ICJ

The Israel-Palestine Conflict and South Africa’s case against Israel before the ICJ  Policy Brief – Taxing for (in-)equality?!

Policy Brief – Taxing for (in-)equality?!  Can 15-minute Cities Be The Solution To Tackle Climate Change?

Can 15-minute Cities Be The Solution To Tackle Climate Change?